Guided Audio Books

Transforming Knowledge into Action

Welcome to your hub for Guided Audio Books—immersive listening experiences designed to help you grow, reflect, and take real steps toward change. These aren’t just books; they’re guided journeys packed with insight, motivation, and practical applications. Whether you’re looking to shift your mindset, overcome challenges, or gain a fresh perspective, you’ll find something here to move you forward.

Each title in this collection is crafted with intention—blending expert guidance, real-life experiences, and actionable takeaways to help you bridge the gap between knowing and doing.

Start Listening. Start Growing.

Explore our collection below.

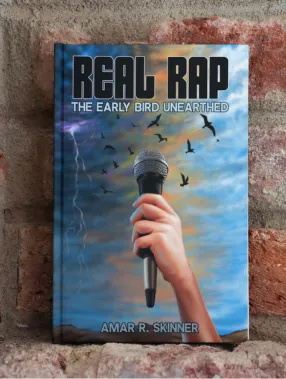

REAL RAP: The Early Birds Unearthed

Some lessons hit harder when they come from lived experience. REAL RAP is not just a book—it’s a raw, unfiltered conversation about life, choices, and the power of transformation. Written for those who’ve faced struggle and those who want to understand it, this guided audio book dives deep into personal growth, resilience, and breaking cycles.

Through sharp storytelling and hard-earned wisdom, REAL RAP challenges you to reflect, unlearn limiting beliefs, and build a future based on purpose, not circumstance.

🔥 What You’ll Gain:

✅A real-world perspective on overcoming setbacks

✅Strategies for shifting your mindset and seizing opportunity

✅A guided, no-nonsense approach to personal development

🎧 Hit Play & Take the First Step.

FAQS

What is the importance of financial planning?

Financial planning is crucial for several reasons. It provides a roadmap to achieve your financial goals, whether it's buying a house, funding your children's education, or retiring comfortably. Through proper planning, you can identify potential risks, such as inadequate insurance coverage or investment volatility, and take steps to mitigate them. Additionally, financial planning helps you make informed decisions by evaluating various options and their potential outcomes. It also ensures that your resources are allocated efficiently, enabling you to manage debt, taxes, and expenses effectively.

How does risk tolerance affect investment decisions?

Risk tolerance refers to your willingness and capacity to withstand fluctuations in the value of your investments. It varies from person to person and is influenced by factors like age, financial goals, and personal preferences. Understanding your risk tolerance is crucial because it guides your investment decisions. If you have a high risk tolerance, you might be more comfortable with aggressive investments that offer higher potential returns but come with greater volatility. On the other hand, if you have a low risk tolerance, you might lean towards more conservative investments with stable, albeit potentially lower, returns. A financial advisor can help align your investment choices with your risk tolerance to create a balanced and suitable portfolio.

How does estate planning benefit my loved ones?

Estate planning involves creating a plan for how your assets will be managed and distributed after your passing. It's not just for the wealthy; it's about ensuring your wishes are carried out and minimizing stress for your loved ones during a difficult time. Through estate planning, you can specify beneficiaries for your assets, designate guardians for minor children, and even make provisions for charitable contributions. Estate planning can also help minimize estate taxes, legal fees, and potential conflicts among heirs. By putting a comprehensive plan in place, you provide your family with clarity and financial security, ensuring that your legacy is preserved and your loved ones are taken care of according to your wishes.